Relief at property prices rising

Usually, price rises aren’t met with a resounding applause. Peculiarly, house prices rising is met with fanfare across the media. When we consider that any other commodity, such as train tickets or food, price rises are cause for protest, this seems fairly suspect.

Generally, house price increases are thought to be indicative of economic growth, but with the property ladder already challenging to get on to, aren’t we further pricing out non-home-owners.

Usually, the media will put itself on the side of the consumer, but in this case, property owners are coming out tops. This shows a clear distinction between who is favoured and who isn’t. There are always people who lose out when prices rise or fall, whether they are farmers or sweatshop workers.

However, contrary to the popular belief that rising house prices are good for the economy, there are others that believe that this is bad for the fiscal health of the country. We’ve become over-reliant on property and don’t invest in the stock market or small businesses instead.

Millions of property owners want house prices to keep on rising because this is their largest asset. Either they’re hoping to rely on it at pension age or they borrow more money than they can sustain and fall massively into negative equity – bad news for everyone.

The Rising Trend

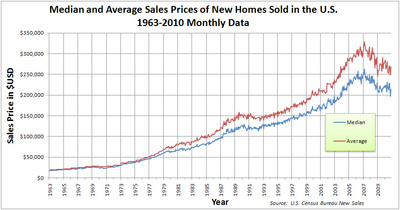

In January, house prices rose at their fastest year-on-year rate since 2010. The housing market will continue to increase in value, after mild economic recovery across the UK (or at least in the south). Since January 2013, prices (on average) have shot up by 8.8%. That makes the average house price £176,491.

There has been an increase in 2013 of first-time buyers, which has led to optimistic feelings about UK recovery. Schemes, such as the government’s Help to Buy, have played their part here.

In the last quarter of 2007, first time buyer’s mortgage repayments (as a percentage of take home pay) became a staggering 51.8%. And this is why, unsurprisingly, first time buyers are hesitant about making that important step towards a mortgage settlement.

Help To Buy

For any house – up to the price of £600,000 – first time buyers can take on equity loans from the government. You can’t sub-let your home through this scheme, but it only requires you to pay 5% of the property price as a deposit. The government will then loan you up to 20% of the price, so you have cheaper mortgage repayments. Click this conveyancing page for more buying support.

Within the first 5 years of owning your home, you won’t be charged loan fees. In the sixth year, you’ll be charged 1.75%. Because the home will be in your name, you can sell it any time you want, but you will have to pay back the equity loan. You can also pay off your equity loan without selling your house; either 10% or 20% of the total amount is acceptable.