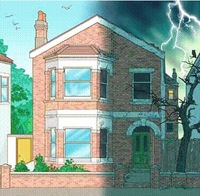

Don’t let your home sweet home be a house of horrors

You've found what you consider to be your home sweet home, but what potential horrors are lurking beneath the paint and the wallpaper?

From the outside, the property you have set your heart on may look perfect – but all too often it is the unseen nasties like rising damp, roof problems or settlement cracking that could turn a dream home into a nightmare.

It is for this reason that surveys are carried out to assess the condition of the property – usually undertaken once an offer on the property has been accepted.

A detailed report on the condition of the property is completed before the purchase goes ahead.

Harrison Murray’s survey department director Chris Battye said: “Most people think the valuation their mortgage lender arranges is a survey: it isn't. It is simply a valuation to make sure the property value covers the loan being taken out against it.

“Don't rely on such limited advice for what is probably your most important purchase. Instruct your own independent survey.”

There are three main survey types:

The RICS Condition Report

Choose this report if you are buying or selling a standard house, bungalow or flat built from common building materials and which is apparently in reasonable condition. A Condition Report is designed to give the buyer information they will not get from their lender’s brief mortgage valuation report. A seller can commission one when they put their home on sale so they are aware of potential problems and are not put at a disadvantage in negotiations with their buyer.

The RICS HomeBuyer Report

The most widely used report. Choose this if you would like more extensive information when buying or selling a house, bungalow or flat built from common building materials and which is apparently in reasonable condition.

Building Survey

You should choose this most comprehensive report if you are buying an older or run down property, a building that is unusual or has been altered, or if you are planning major works. It costs more than the RICS Reports because it gives more detailed information about the structure and fabric of the property. The Building Survey will highlight those matters you should give priority to over the items that can be dealt with as part of routine maintenance

It does not include a valuation or insurance rebuilding figure, but we can provide one as a separate service if required.

And to help with the customer journey, Harrison Murray independent estate agents and valuers have their own surveying department to deal with those all-important questions and answers.

Chris added: “Most people think that finding the property and putting in an offer is the hardest part of buying a house – but then comes the surveys! These can be something of a minefield for people who are new to the process of buying a house, but Harrison Murray can gently and professionally guide them through this very important aspect of the journey.”

All Harrison Murray surveys are carried out by experienced chartered surveyors who are members of the RICS (Royal Institution of Chartered Surveyors). For more information on the service, visit hmsurveys.co.uk.